Minnesota Mechanic’s Liens

Hennessey Law Office PLLC helps contractors, subcontractors and suppliers with mechanic’s lien enforcement, including service of preliminary lien notices, filing and service of mechanic’s lien statements, and mechanic’s lien foreclosure lawsuits.

If the required steps for preserving and enforcing a mechanic’s liens are followed, liens can be a powerful tool for enforcing contractor, subcontractor or supplier claims for money owed to them on a job. A construction law attorney can assist with sending out any required preliminary lien notices, filing and serving mechanic’s lien statements, negotiating settlement of lien claims, or representing lien claimants in lawsuits to foreclose mechanic’s liens in situations where favorable settlements are not possible.

Below is some basic information about mechanic’s liens claims in Minnesota. If you have questions about mechanic’s lien rights on a particular job, give us a call.

Minnesota Mechanic’s Liens – An Overview

What you don’t know about mechanics’ liens can hurt you. But if you understand how they work, and are careful about following the rules, they are a powerful tool for getting paid – similar to having a mortgage against the project. On most private construction projects in Minnesota, state law entitles contractors, subcontractors, and suppliers who contribute labor or materials for the “improvement” of real estate to enforce a lien against the improved real estate as a means of getting paid. Even though Minnesota Statutes § 514.01 specifically refers to “mechanics, laborers, and material suppliers,” the claim is referred to as a “mechanic’s lien” no matter who is asserting it. Some other states refer to these as a “contractor’s lien” or “construction lien,” but it’s the same concept. Regardless of the terminology used, such liens can be an extremely powerful remedy that a contractor, subcontractor or supplier can rely upon to get paid for work completed on a project.

Minnesota’s lien statutes are designed to balance the risks undertaken by the project owner against the risks undertaken by those who furnish labor and materials to improve the owner’s property so as to ensure that the owner’s money flows down to those entitled to receive payment for their work. In some situations, liens may even be enforced so as to make an owner “pay twice” for the same labor and material – as may be the case if the owner paid the general contractor for completed work and for some reason the general contractor (or a subcontractor further down the contract chain) failed to pass the money on to its subcontractors and suppliers who furnished labor or material for the project.

In order to preserve its lien rights, a lien claimant may be required to give very specific written “preliminary notice” to the project owner at the time of contracting (general contractor’s preliminary notice) or near the beginning of its work on the project (subcontractor/supplier’s preliminary notice). There are a number of exceptions to the preliminary notice requirement. On most larger projects of a commercial nature, owners are assumed to be more sophisticated and are not entitled to as much procedural protection as a typical homeowner. Nevertheless, the procedures lien claimants and owners must follow are similar on both small, residential jobs and big, commercial jobs. In all situations, a lien claimant must always serve its mechanics’ lien statement on the project owner, and file it with the appropriate county property records office, within 120 days of the date the lien claimant last furnished labor or material for the project. The procedures lien claimants and project owners must follow are not difficult, but much can go wrong if those procedures are not followed to a “T.” For the lien claimant, missteps can mean the difference between a valid lien and an invalid lien, which can often be the difference between getting paid in full or not at all.

Even though the owner has no contractual obligation to pay anyone other than its prime contractor (who the owner may have already paid in full), the improved real estate (and the owner’s interest in the real estate) is still subject to valid liens. The project owner often has certain obligations to fulfill before it releases payments to its general contractor. In theory, these procedures should ensure that most valid lien claims get paid, and that the owner won’t have to “pay twice” for the same work. On some smaller projects the owner may have some protection from having to pay twice for the same work (see other tab on this page labeled “Limits on Lien Amount”). Missteps by an owner can mean having to pay twice, or having to face a lien foreclosure lawsuit where lien claimants ask the court to force a sale of the real estate to satisfy valid liens. A savvy project owner, or its attorney, will carefully review each mechanic’s lien filed against its project to evaluate whether any are obviously defective. It may be impossible to tell which liens are valid until more facts are revealed during a lawsuit to foreclose or remove mechanic’s liens.

The many reasons why liens get filed on projects are too long to list. There could be a problem with quality of someone’s work that someone else doesn’t want to pay for. Sometimes it has nothing to do with the quality of the work itself, and liens arise because the owner, the prime contractor or a sub went over budget (or is having cash flow problems completely unrelated to job) which results in people further down the contract chain not getting paid. If your concerned about getting paid on a job, or concerned about the validity of liens against your project, give us a call.

Who can file a mechanics’ lien?

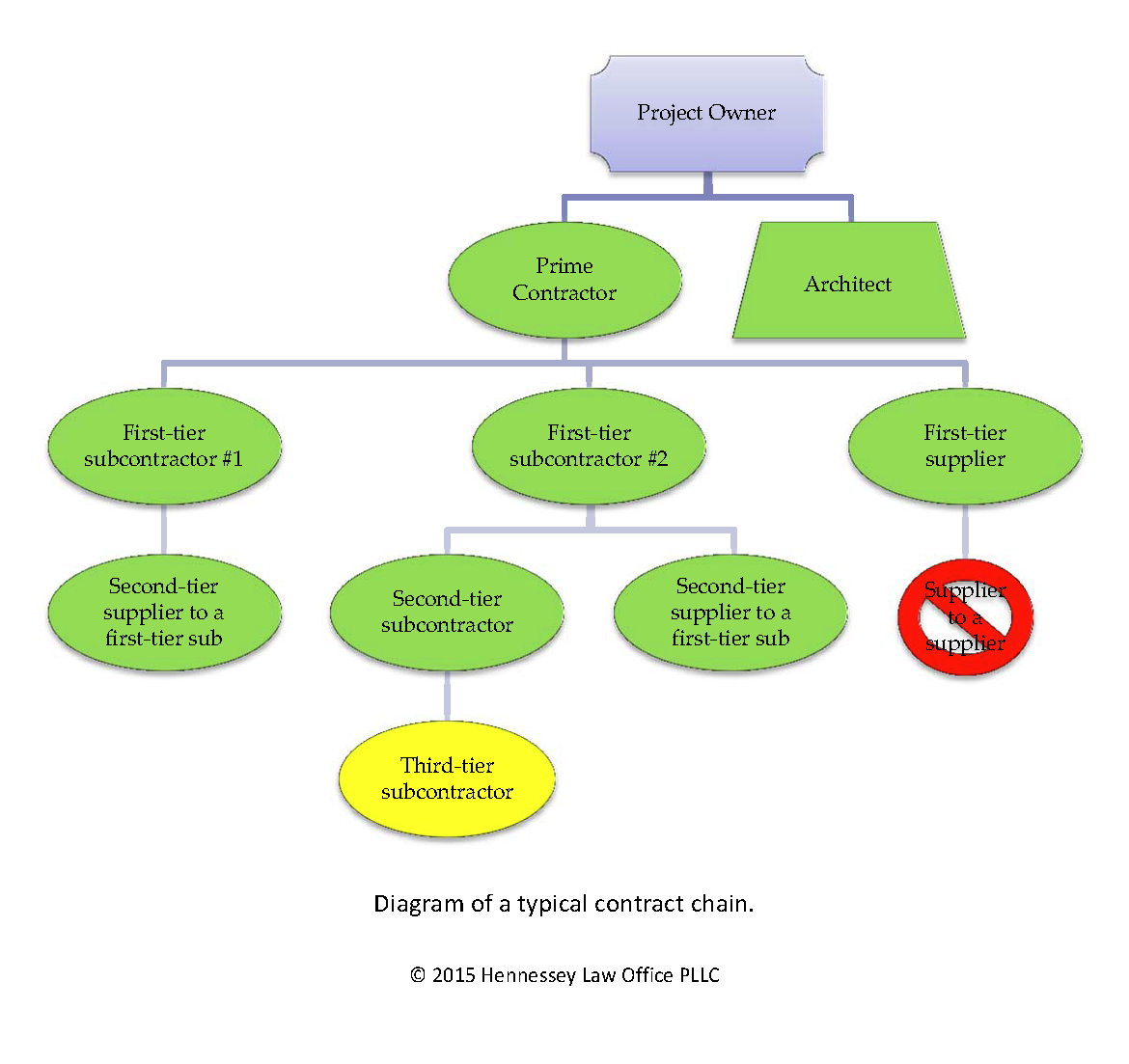

Where you fall in the chain of contracting parties will determine if you are entitled to assert a lien. Not everyone who contributes to an improvement to real estate is entitled to a lien. Even if the labor or materials that you intend to furnish might be lienable in some situations, the exact same kind of labor and materials may not be lienable in other situations. It depends on where you fall in the “contract chain” – the series of contractual relationship starting with the project owner and extending all the way down to the lowest level subcontractor or supplier who furnished something for the job. Knowing the identities and roles of the various parties above you in the contract chain is critical if you want to know if you will have lien rights on a job. In Minnesota, the parties entitled to assert a lien are limited to persons who have a contract with: • The owner; • The prime contractor (the one who contracts directly with the project owner); • A subcontractor of the prime contractor (a/k/a “first-tier subcontractor”); and • A sub-subcontractor of the prime contractor (a/k/a “second-tier subcontractor”) • In the past, there has been at least some disagreement among construction law professionals about whether a “third-tier” subcontractor or supplier (a/k/a “sub-sub-subcontractor” – one who has a contract with a second-tier subcontractor) is entitled to assert a lien. We’ve seen liens paid at this tier-level, but we’ve also seen owners and/or prime contractors challenge such liens based on an argument that the lien claimant was “too remote”- too far removed from the top of the contract chain to be permitted to assert a lien. A challenge to the lien is especially likely if the owner would be forced to “pay twice”- more than it agreed to pay the prime contractor under the prime contract. Eventually, this issue will be decided by the Minnesota courts to remove any uncertainty. Until there is clear legal authority to the contrary, we recommend that a subcontractors file liens to protect themselves.

Which jobs are “lienable”?

To qualify as an lienable “improvement” in Minnesota, one rule says that the work must involve a permanent addition to or betterment of real property that enhances its capital value by making it more useful or valuable as distinguished from ordinary repairs. In the vast majority of situations, it’s easy to know there has been an improvement. Concrete, lumber, sheetrock, windows, doors, electrical and plumbing supplies, HVAC equipment, and any number of other forms of labor and material have all been assembled and incorporated into a newly finished building or addition. A new building or addition is clearly permanent. It any typical situation, the completed project will have increased the value of the real estate or made it more useful. Unfortunately, there can be gray areas. Here are a few not-so-uncommon situations that can come up:

- What if I delivered my material to the job site but the materials were never actually used?

- What if my customer diverts my materials to some other project without telling me?

- What if I custom-manufactured custom equipment or materials at my factory that is intended for this one particular project but work on the project stopped before my product was delivered to the job site or installed?

If you have an usual situation, we suggest that you give us a call to talk about it.

What kinds of labor and materials are “lienable”?

Assuming a project involves a permanent improvement to real estate, then the labor, skill, material and machinery used in constructing the improvement are all potentially “lienable”. If there is a permanent improvement, just about anything could be lienable under Minnesota’s lien statute, the relevant portion of which reads as follows:

514.01 MECHANICS, LABORERS AND MATERIAL SUPPLIERS. Whoever performs engineering or land surveying services with respect to real estate, or contributes to the improvement of real estate by performing labor, or furnishing skill, material or machinery for any of the purposes hereinafter stated, whether under contract with the owner of such real estate or at the instance of any agent, trustee, contractor or subcontractor of such owner, shall have a lien upon the improvement, and upon the land on which it is situated or to which it may be removed, that is to say, for the erection, alteration, repair, or removal of any building, fixture, bridge, wharf, fence, or other structure thereon, or for grading, filling in, or excavating the same, or for clearing, grubbing, or first breaking, or for furnishing and placing soil or sod, or for furnishing and planting of trees, shrubs, or plant materials, or for labor performed in placing soil or sod, or for labor performed in planting trees, shrubs, or plant materials, or for digging or repairing any ditch, drain, well, fountain, cistern, reservoir, or vault thereon, or for laying, altering or repairing any sidewalk, curb, gutter, paving, sewer, pipe, or conduit in or upon the same, or in or upon the adjoining half of any highway, street, or alley upon which the same abuts.

You can see the Minnesota legislature threw in just about anything and everything, including the kitchen sink, into the open-ended list of “lienable” items. Not sure if your work will be lienable? Give us a call to talk about it.

Steps for enforcing a mechanic’s lien in Minnesota.

In Minnesota, if a project is “lienable,” a lien will automatically spring into existence the moment someone furnishes labor or material to improve real estate owed by another.

On some types of jobs, including most residentail projects contracted for by the homeowner, a lien claimant wanting to preserve its mechanic’s lien claim is required to serve a written preliminary notice to the project early on during the project.

On all jobs, a lien claimant must serve and file (record in the county property records system) a mechanic’s lien statement.

The form and content of lien notices, the manner in which they are delivered, and the deadlines they must be given by, must strictly comply with the requirements of Minnesota’s lien statutes. Complying with these requirements go a long way to ensuring a lien claimant will be paid, but does not guarantee it.

How much of a claim is protected by a mechanic’s lien?

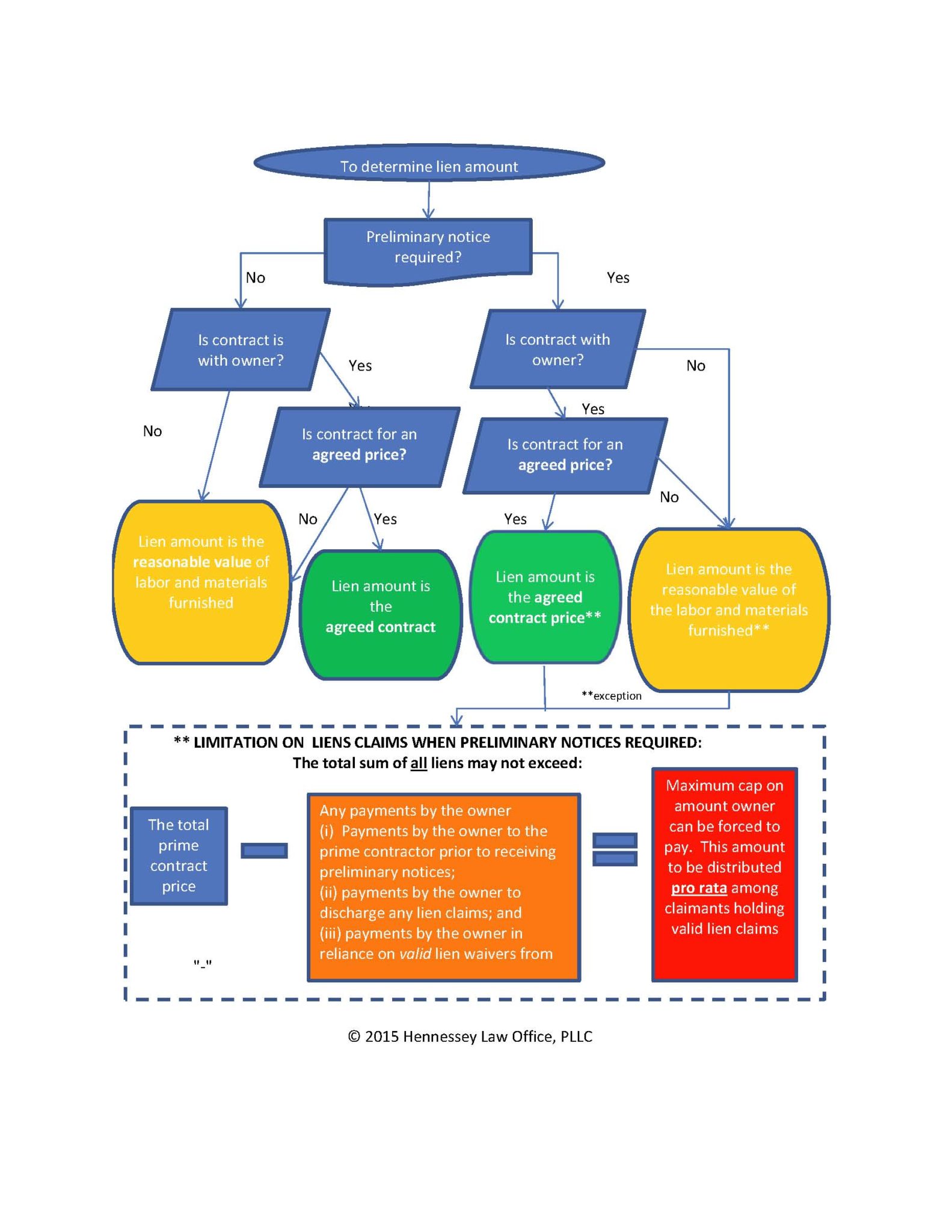

The amount protected by a mechanic’s lien is governed by Minn. Stat. § 514.03. The statute is an attempt to balance the risks undertaken by the project owner with risks undertaken by those who furnish labor and materials to improve the owner’s property. In some situation, it would be unfair for a property owner to enjoy the benefit of labor and materials used to improve his property without paying for it. In other situations it might be unfair to make an owner “pay twice” for the same labor and material – as may be the case if the owner paid the general contractor for completed work and for whatever reason the general contractor (or a subcontractor further down the contract chain) failed to pass the money on to their subcontractors or suppliers.

On some jobs where preliminary notices are required, there may be a cap on the total amount of all lien claims the owner can be forced to pay. Minn. Stat. § 514.03, subd. 2(c). On such jobs, the owner may be protected from having to “pay twice” (more than the prime contract price including approved change orders) if the owner paid the prime contractor before it received preliminary notices from subcontractors or suppliers. Alternatively, an owner who has been served with preliminary notices by subcontractors or suppliers is allowed to hold back a portion of the prime contract price from the prime contractor in order to pay the parties who served preliminary notices. By holding back money, the owner may be able to see to it that valid lien claims are paid, and then pay the prime contract only what remains after valid liens have been satisfied.

Application of the statute isn’t always so easy. The amount and timeliness of liens may be disputed, and parties may dispute whether preliminary notices were or were not required on a particular project. We have also seen situations where unscrupulous contractors and subcontractors have forged lien waivers purporting to be from their subcontractors and suppliers in order to induce parties higher up the contract chain to release payment. In messy situations, application of the rules can be harder to sort out.

Below is chart that helps explain how the amount of lien is determined. Keep in mind that at this point we are only talking about the principal amount of the lien. A successful lien claim may also be entitled to recover not only the principal amount of its lien but also interests, court costs, and reasonable attorneys’ fees in excess of the amount listed here.

Hennessey Law Office PLLC can serve preliminary lien notices, file mechanic's liens, and foreclose liens on projects throughout Minnesota. Unlike a "lien service company' which may only refund the fee you paid if they make a critical mistake with your lien, Hennessey Law Office, PLLC is an insured, full service law firm where an attorney will review and coordinate the service and filing of your lien. Not only are we insured, we are able to provide follow up services including demand letters and lien foreclosure services if your lien is not paid promptly.

Mechanic's lien filings and foreclosures: Counties we serve

Aitkin, Anoka, Becker, Beltrami, Benton, Big Stone, Blue Earth, Brown, Carlton, Carver, Cass, Chippewa, Chisago, Clay, Clearwater, Cook, Cottonwood, Crow Wing, Dakota, Dodge, Douglas, Faribault, Fillmore, Freeborn, Goodhue, Grant, Hennepin, Houston, Hubbard, Isanti, Itasca, Jackson, Kanabec, Kandiyohi, Kittson, Koochiching, Lac Qui Parle, Lake, Lake Of The Wood, Le Sueur, Lincoln, Lyon, Mahnomen, Marshall, Martin, McLeod, Meeker, Mille Lacs, Morrison, Mower, Murray, Nicollet, Nobles, Norman, Olmsted, Otter Tail, Pennington, Pine, Pipestone, Polk, Pope, Ramsey, Red Lake, Redwood, Renville, Rice, Rock, Roseau, St. Louis, Scott, Sherburne, Sibley, Stearns, Steele, Stevens, Swift, Todd, Traverse, Wabasha, Wadena, Waseca, Washington, Watonwan, Wilkin, Winona, Wright, Yellow Medicine.